Huawei Profile

Huawei

Huawei scores as a SEVERE RISK in the October 2023 Chip Risk Monitor for investment, supply, research, and industrial policy ties to the Chinese government and military bureaucracies.

Huawei has been placed on the Department of Commerce’s Entity List, the Department of the Treasury’s Chinese Military-Industrial Complex List, and the Department of Defense’s Communist Chinese Military Company (1260H) list.

Background

Huawei was among the first sources of US and global concern over China’s techno-economic threat. And the campaign to defend against Huawei’s threat has served as a template for those that followed. Yet Huawei continues to operate and grow not only in China but also internationally. As it does so, Huawei is developing an information technology value chain and ecosystem under its control. This effort risks not only stymying efforts of the global system to defend against PRC bad actors but also making that system depend on those bad actors.

International attention to Huawei’s risk grew significantly in 2017, after the discovery of a five-year Chinese hack of the African Union Headquarters, which had been supplied by Huawei and paid for by Beijing. In 2019, the US Department of Commerce added Huawei to the Entity List. In 2021, the US Department of Defense listed Huawei as a Chinese military company. That same year, the Department of the Treasury placed Huawei on the Non-SDN Chinese Military-Industrial Complex list.

Objective Risk

Huawei appears to be government influenced through both ownership and subsidies; to empower PRC military, military-civil fusion, and surveillance players; and all the while to be building up foundational footholds in the global information technology ecosystem.

Ownership Risks

Huawei is notorious for being opaque about its ownership. The company is not publicly traded and therefore has no obligation to disclose shareholders. An English-language Google search of Huawei’s ownership yields, as the top result, a statement from the company “Huawei is an independent, privately-held company. We are not owned or controlled by, nor affiliated with [sic] the government, or any 3rd party corporation. In fact, Huawei is owned by our employees through an Employee Stock Ownership Program.”

However, more in-depth exploration tells a slightly more textured story. Chinese corporate records show that Huawei is owned by a holding company called Huawei Investment & Holding. That company has two shareholders: Huawei CEO and founder Ren Zhengfei, with an approximately one percent stake, and an entity called the Union of Huawei Investment & Holding, which holds about 99 percent.

The Union of Huawei Investment & Holding is reportedly Huawei’s labor union. But Chinese unions are not autonomous, employee-responsive structures. All enterprise unions in China must be registered with the All-China Federation for Trade Unions (ACFTU), a government body that answers directly to the Central Committee of the Chinese Communist Party. The ACFTU serves the interests of the CCP and local governments; PRC unions predominately defer to Chinese government and Party organizations.

This suggests the Chinese government has influence over Huawei’s ownership – in addition to any influence over individuals associated with the company, company subsidies, and company business. For example, in 2022 Huawei reportedly received some 6.5 billion RMB In Chinese government subsidies.

Research and Supply Partnership Risks

Huawei has an established track record of working with the PRC military, military-civil fusion, and surveillance ecosystems. And Huawei continues to build and expand such partnerships. For example:

· In July 2023, Huawei and China Electronics (CEC) merged their Kunpeng and PKS Ecosystems. CEC is one of the PRC’s backbone State-owned military companies and on the Department of Commerce’s Entity List. Both Kunpeng and PKS are information systems intended to empower secure, indigenous capabilities; PRC coverage of the cooperation describes it as evidence of “deepening cooperation between Huawei and large central enterprises.” CEC’s PKS leverages Phytium’s 2000-series CPU and Centec’s Tsingma series switching chips. Phytium and Tsingma are on the Department of Commerce’s Entity List. In 2020, CEC’s PKS was named one of the “Top Ten News of [China’s] National Defense Technology Industry by China’s State Administration for Science, Technology, and Industry for National Defense in 2019, alongside the launch of China’s first domestically-made aircraft carrier. It appears to have supported surveillance applications including Intellifusion’s “Deep Eye” portrait recognition, used in Xinjiang among other applications.

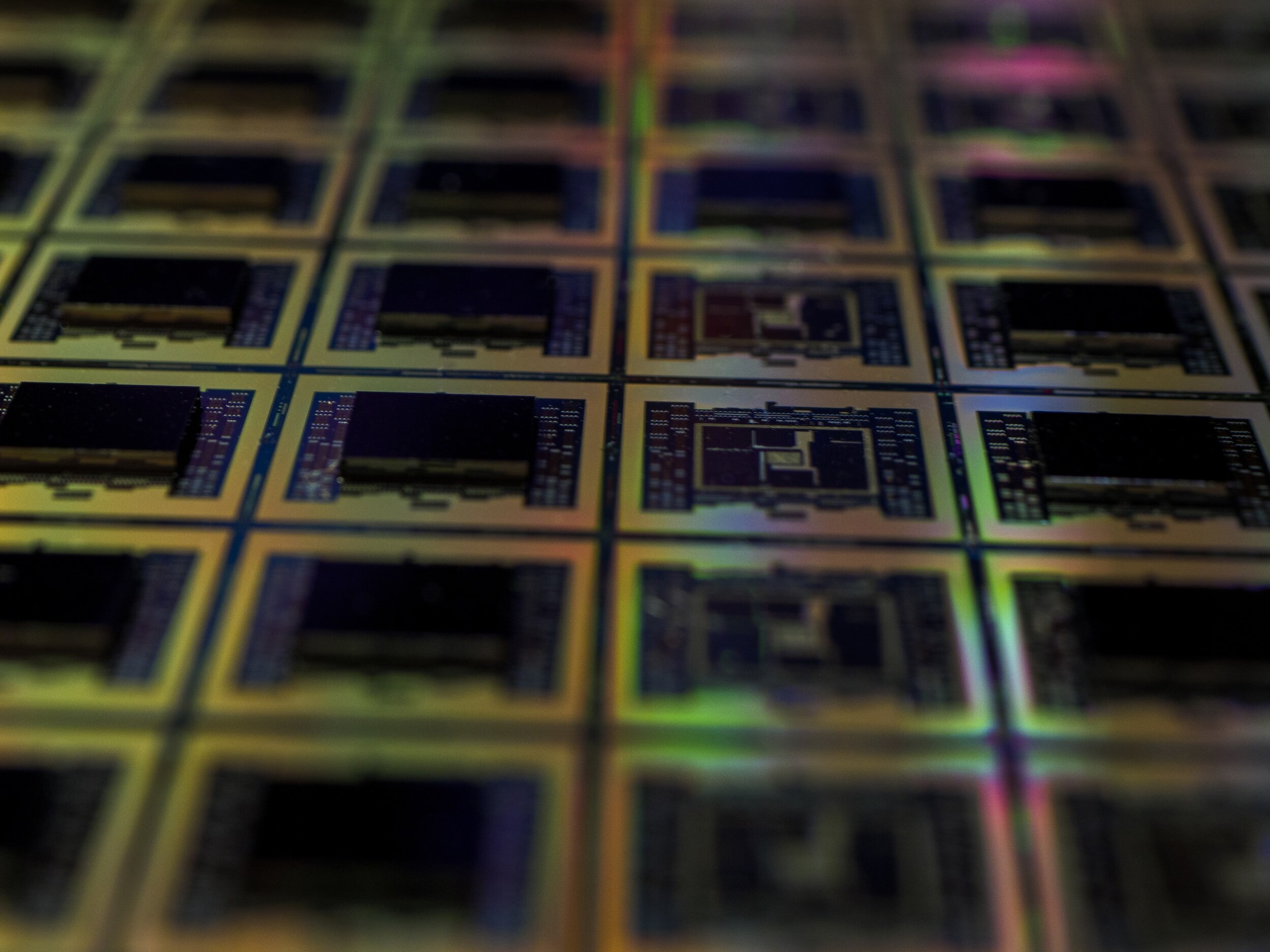

· In August 2023, Huawei released a new 5G phone build around a chip manufactured by SMIC. The partnership between the two companies reportedly stemmed from a March 2023 PRC government move to make Huawei and SMIC, among other Chinese companies, the core to a new government bid for self-reliance. SMIC has been placed on the Department of Commerce’s Entity List and the Department of the Treasury’s Chinese Military-Industrial Complex List.

· Huawei works with PRC local governments to support smart city development and other forms of digital governance positioned to empower the Chinese surveillance state: In September 2023, Huawei and Gansu Province held a signing ceremony to celebrate their strategic cooperation in artificial intelligence computing platforms, digital government, and smart city cooperation; as early as 2016, Huawei and Guizhou Province signed a strategic cooperation agreement on big data, smart cities, and safe cities; Huawei’s Government Affairs Network Corps has established a partnership dedicated to “deepening urban digitalization.”

More generally, Huawei publicizes its support for the PRC’s military civil fusion strategy. For example, the Huawei Cloud website declares, in Chinese, “learn to accelerate the formation of an in-depth pattern of military civil fusion.

Expansion Risks

Huawei has been front and center in US and international concerns over China’s techno-economic offensive – and the risks it presents. Yet despite years of efforts to defend against those risks, Huawei continues to operate and grow in China and internationally. This is particularly evident in semiconductor materials, including indium phosphide, an area where the PRC is working on building up strengths to enhance its leverage over global value chains.

Take, for example, Yunnan Lincang Xinyuan Germanium Industry Co., Ltd., or Yunnan Germanium for short. Its subsidiary, Yunnan Xinyao Semiconductor Materials Co., Ltd., kicked off production of indium phosphide monocrystalline wafers in April 2022. The company is backed by Huawei’s venture capital arm, Hubble Investment, which in 2021 took a nearly 24% stake in the firm.

“Huawei’s investment in Yunnan Xinyao Semiconductor Materials Co., Ltd. is to safeguard its supply chain security in semiconductors for optical communication,” writes one Chinese analyst.

According to Yunan Xinyao Semiconductor Materials, the company as of May 2023 has an annual production capacity of 150,000 two- to four-inch indium phosphide wafers, and supplies the semiconductor materials to around 90 clients.

In short, whether through the Kunpeng-PKS merger or indium phosphide, Huawei is continuing to build up an information technology value chain and ecosystem under its control. In so doing, Huawei risks not only stymying efforts of the global system to defend against PRC bad actors but also making that system depend on those bad actors.

Read More on Huawei’s Risk:

- “China Made a Chip Breakthrough that Shocked the World,” Bloomberg, December 2023.

- “China as a Cyber Great Power: Beijing’s Two Voices in Telecommunications,” Brookings, April 2021.

- “A Compound Problem: Dialing in US Semiconductor Strategy,” Real Clear Defense, August 2023.

“Beijing is competing over and through international supply chains. That makes them a matter of national security. It makes their vulnerabilities threats to national security. As long as industry fails to address those vulnerabilities, industry is sabotaging American security..”

— Nathan Picarsic and Emily de La Bruyère, co-founders of Horizon Advisory